Hmrc : Photo Gallery

Hmrc : Videos

Hmrc : Latest News, Information, Answers and Websites

Scheme to resolve SME disputes with HMRC launched | News | EN ...

According to Jim Stevenson, assistant director, local compliance, at Hmrc, the new Alternative Dispute Resolution (ADR) initiative will resolve disputes without the need to go to a tribunal. Under the terms of the scheme independent ...

HMRC: Login

Are your contact details up to date? Its really important that your contact details are kept up to date so that Hmrc can confirm your submission receipt by email and ...

Sophos Detects Fake E-mails Masquerading HMRC

According to researchers from Sophos the security company, e-mails posing as messages from Hmrc (Her Majesty's Revenue & Customs) the tax-collection body of UK are presently circulating online while aiming at ...

Forum Of Private Business Slams HMRC For Harrassing Small Businesses

Amid rising red tape small business body warns firms to prepare for paperwork clampdown and pay tax bills on time or face large fines The Forum of Private Business is warning firms to pay their tax bills on time or face large fines, amid ...

HM Revenue & Customs: Self Employed

We would like you to know. Tax return deadlines and penalties During the tax year (6 April one year to 5 April the next) there are key dates by which you need to send ...

Forum slams HMRC's 'harassment and mistreatment' of small ...

The Forum has written to David Gauke, the Exchequer Secretary to the Treasury, to complain about Hmrc's 'harassment and mistreatment' of small businesses, including imposing steep fines for even slight delays in tax bill ...

HM Revenue & Customs: VAT

New ESL threshold. From 1 January monthly ESLs are required if EU supplies of goods exceed £35000 in the current or four preceding quarters. You are here ...

HM Revenue & Customs:Starting in business

We also point to some other important areas of the law which aren't the responsibility of HM Revenue & Customs (Hmrc)- and we suggest where to go for ...

No hope of independence in HMRCs mediation service

The tax authority is ready for mediation. Notwithstanding HM Revenue & Customss propensity to roll over and beg when the likes of Vodafone or Goldman Sachs demand to pay less tax, its tough-talking officers are offering small and medium-sized businesses ...

Cooking the books: Fast food faces taxman probe

But Britains fast-food restaurants have been put on notice: the taxman is after them. Hmrc, under fire lately for approving supposed sweetheart deals with big firms such as Vodafone and Goldman Sachs, reckons it has found a tasty new target. Spurred by a ...

Health Management Research Center - University of Michigan

Click the tree to see knowledge created at Hmrc. UM-Health Management Research Center (UM-Hmrc) is a world-wide leader in studying how health choices influence total

How long does HMRC take to provide information to cica inorder it may compensate me for loss of earnings?

Every time we write to them in regards to the inury claim,they say that they are awaiting a letter from Hmrc.How long should it take to get this letter?what options are there?i feel its taking it too long.

Answer: Feelings have nothing to do with it. You have to call Hmrc and ask them what's taking so long.

Category: Insurance

Can HMRC give a potential employer your employment history?

The potential employer gets your National Insurance number from the employment application which you fill out. Can they then ask Hmrc to give them your previous employment history?

Thanks.

Answer: No, they do not even HAVE your previous work history in a form useful to the employer.

There are other ways for the employer to know if you lie on your application, however.

Category: Law & Ethics

Who do i notify at HMRC when closing a company?

I am closing my limited company(no debts, activity,transactions,not registered for vat etc)

Who do i notify at Hmrc? what office?

I am based Glasgow

Thanks in advance

Answer: You notify the office which deals with your Corporation Tax and the office which deals with the PAYE ffairs of your directors. These references will be found on returns, notices of coding and other documets.

Category: Corporations

Will corruption in HMRC be fully investigated by the Government?

Bosses within Her Majestys Revenue and Customs have made concessions towards Vodafone and other huge firms over their tax liabilities following lunch dates between the bosses and companies.

The outcome is that these companies have had billions of tax liabilities waived and the Hmrc bosses have been paid record bonuses.Many Hmrc stall have received honours in the New Years Honours list.

With small firms being persecuted out of business by this same agency, can we expect a full investigation into these inconsistent activities, and huge bonuses paid to the perpetrators?

Or a whitewash?

Answer: No.Big companies ,banks and the rich transfer billions over seas to off shore tax havens and use tax loopholes to avoid taxes or do private deals with government officials.This corruption is common place in the UK.By doing nothing about it the government encourage this corruption.People in the UK are dying from cold and hunger to subsidise these activities but that is not enough the government has to borrow billions so this can continue.If riots come to London during the Olympic games to highlight this obscenity I would not be surprised.I do not agree with riots but the government obviously ignore peaceful protests.

Category: Law & Ethics

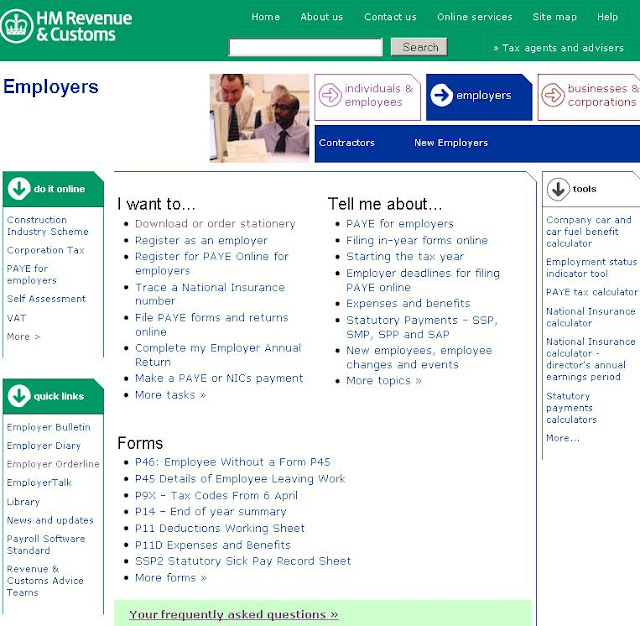

HM Revenue & Customs: Home Page

Includes information about the UK's customs and tax department and includes the prototype on-line VAT (Value Added Tax) returns system.

What is the last date for filing tax to HMRC UK and how much is the penalty for being late?

Hi,

I am out of UK since last couple of months, I have been receiving the letters, etc from Hmrc quite late because of the distance. I have finally for my user id and not waiting for activation pin. I had to go for online process because it took 27 days for the form to reach me and back.

Please advice how what is the last date for filing tax for year 2006 - 2007 ... and how much is the late penalty.

Answer: Statutory filing date for 2006/07 is 31 January 2008. If you are late in filing then the statutory fixed penalty (if this is first time you are late in filing) is £100.

Category: United Kingdom

HM Revenue & Customs: Self Employed

We would like you to know. Tax return deadlines and penalties. During the tax year (6 April one year to 5 April the next) there are key dates by which you need to ...

if i have 2 self employed jobs do i need to register with HMRC twice as self employed?

i am already registered as a self employed driving instructor.

I am starting soon as a self employed taxi driver to boost my income a bit.

do i need to tell Hmrc that i am starting soon as a taxi driver & register as self employed a 2nd time?

thanks.

Category: Personal Finance

What are the ways to get a TAX RETURN from HMRC?

In the last few months i called Hmrc many times asking them to send me a tax return form, got promises but never received anything from them. I don`t trust call centres anymore, what are other ways to get it, cuz i`m afraid i run out of time and won`t be able to return it on time. What`s the deadline anyway?

Answer: There is plenty of time for the present year. You can do everything on line.

Category: United Kingdom

United Kingdom: HMRC VAT Amnesty Alert

Chiene + Tait today issued an alert to all businesses regarding VAT registration. Hmrc has a 30th September deadline for all businesses that should be VAT registered to notify them, otherwise the full weight of penalties will be issued. If a business is ...

How to tell HMRC that I am no more a UK tax payer?

Hi, I have left UK 2 years back but I keep receiving reminders(at my home country address) from Hmrc to file my tax returns. How do I notify Hmrc that I am no more a UK tax payer?

Answer: If Hmrc issues a tax return you have to complete it, its the only way to stop them coming. Even a nil return will satisfy them.

Category: United Kingdom

HM Revenue & Customs: Home Page

The HM Revenue & Customs (Hmrc) website ... Hmrc accepts faster payments From 16 December 2011 you can pay Hmrc using the Faster Payment Service

How to close limited company and business bank account and informing HMRC?

I want to close my business, its a limited company, no employees except myself as a director, no debts. we are VAT registered but havnt trade for the last 3 months. I know I need to fill out a form downloaded from Companies House. but what do I do with my business bank account? I still have a few hundreds in my business account, can I take them out? also How to I advise Hmrc about my business closing?

Thanks!

Answer: When I sold my business I was advised to keep the business bank account open for a few months. You need to advise the VAT people so they can send you a final return. You write to Hmrc with details of your business telling them that you have ceased trading.

You need to keep your accounts and paperwork for 7 years as you can be invesigated at any time.

Category: London

Taxman blitz on super-rich footballers: HMRC investigates secret perks given to stars and their families

Premier League stars and their clubs are being investigated by the taxman over the secret perks enjoyed by players and their families. Investigators from Her Majesty’s Revenue & Customs have interviewed finance directors at Britain’s richest clubs to ...

HMRC Is Shite: HMRC Accepts Faster Payments..Sort Of

"From 16 December 2011 HM Revenue & Customs (Hmrc) will be able to accept payments made using the Faster Payments Service. This will allow you to make faster electronic payments, typically via internet or telephone ...

HM Revenue & Customs: Self Assessment and your tax return

Deadline for online tax returns Your tax return must reach Hmrc by midnight 31 January. Register for Hmrc online services before its too late

HM Revenue & Customs: Self Assessment and your tax return

Need help with your tax return? Find out what you need to do, when and how.

HMRC | Facebook

Hmrc - Description: Her Majestys Revenue and Customs (Hmrc) is a non-ministerial department of the UK Government responsible for the collection of taxes and the ...

HMRC - Twitter

Her Majesty's Revenue and Customs (Hmrc) (Welsh: Cyllid a Thollau Ei Mawrhydi) is a non-ministerial department of the UK Government responsible for the ...

UK taxman should be tougher on big firms - Cameron

His comments follow a report in December by members of parliament who said "cosy" relations between big companies and Hmrc, the tax authority, gave the impression that it was softer on them than it was on individuals and small businesses.

HMRC trains 'mediators' for small business tax disputes | SpinnerNews

Hmrc is assessing whether its own inspectors can act as mediators between colleagues and.

I cashed in a pension via a small company and HMRC want me to pay the tax. I am appealing it how can I win it?

Hmrc say the transfer was illegal - I used the money to live on after being made redundant. Can I put up a winnable case ?

Answer: no, you cant win... sorry... the problem is that the money has not been taxed yet.... it has to be taxed once.... if it is your money like you say, then it is your responsibility to pay the tax...... I had this happen before...next time you pick a retirement plan do an IRA or something. sorry..

Category: United Kingdom

TaxAssist Accountants - HMRC issues tax return reminder

Taxpayers have been reminded of the forthcoming deadline to file their online tax returns.

MSB that is already registered with HMRC to register with the FSA?

Hi,

Is there any requirement for an MSB that is already registered with Hmrc to register with the FSA? If so, what are the conditions and requirements?

B

Answer: What's MSB? Registration with Hmrc has absolutely nothing to do with the FSA requirements so whatever the MSB is, if it's involved in financial matters, it almost certainly will have to register separately. Unless you mean the Food Standards Agency.

Category: United Kingdom

Can I borrow money from friends and family for a large deposit without HMRC getting involved?

Can I borrow money from friends and family for a large deposit on a house/business premises?

I can get a mortgage but I dont have money for a deposit, so HOW can I show to Hmrc in UK that friend and family have borrowed money or given money to me as a gift and also legit. So i can put it down as a deposit, which is going to be a large sum? Does Hmrc have to know?

Answer: The only thing anybody will ask you about is where the deposit is coming from i.e savings or loan.If it was a loan then this may effect the amount of mortgage you can get but if you can prove it is a gift from family and not money laundering then that should be ok.The amount a family member (usually a parent) can gift annually to a son or daughter is fixed at a certain amount (not sure what it is) to avoid your paying tax on it.

Most rules are really to avoid money laundering so look into this carefully to avoid pitfalls.

If you are borrowing this money,can you afford a mortgage and repayment of these other loans?

It may pay you to consider rental until your Business proves it is viable.

Category: Renting & Real Estate

Small firms harassed by taxman, industry claims

The criticism of HM Revenue & Customs (Hmrc) comes from the Forum of Private Business (FPB), which said that small firms were facing a rising tide of red tape. It spoke out after allegations that Hmrc’s paperwork spot checks regime is targeting small ...

Can anyone pls tell me how long does it take for HMRC to pay back business mileage allowance claim?

I have never claimed my business mileage but been driving for the last four years. Can I back date my application using the same P87? And How long does it take for the Hmrc to actually process the application & refund the money? Do they ask for any additional documents if the claim is about £1000 per year? Thanks.

Answer: You will need a separate form P87 for each year, and go back six years.

Hmrc has targets of 28 days to reply to correspondence. But it depends on staffing levels (minimal everywhere these days) and office workstate. Then any cheque gets sent out by 2nd class post.

Category: United Kingdom

HMRC phishing scam promises end of year refund | Naked Security

Emails are currently circulating that purport to be sent by the UK tax organization HM Revenue & Customs (Hmrc). These e-mails claim that the recipient is ...

HMRC tax drive attacked as shameless fundraising

HM Revenue & Customs sparked fresh outrage after announcing their plans to plug a £7bn tax void by targeting small enterprises, and fining those with incomplete records £3000. Commentators bemoaned the hypocrisy of Hmrc’s strategy, which seemingly ...

HM Revenue and Customs - Wikipedia, the free encyclopedia

Her Majesty's Revenue and Customs (Hmrc) (Welsh: Cyllid a Thollau Ei Mawrhydi) is a non-ministerial department of the UK Government responsible for the ...

if I choose a bad accountant, am I more likely to get investigated by HMRC?

Im shortlisting a few accountants in my area, but its difficult to say which have a good reputation and which dont. Will it make a difference which accountant I go for? Is Hmrc biased towards some accountants over others? Im just starting a new business so need some advice. Thanks in advance.

Answer: Ask around your locality , people you know and can trust or your bank manager for a name of a good local accountant.

It is rare to find a bad accountant but a good accountant , better than the rest is the one you need.

Category: United Kingdom

HMRC phishing scam promises end of year refund

Emails are currently circulating that purport to be sent by the UK tax organization HM Revenue & Customs (Hmrc). These e-mails claim that the recipient is eligible to receive a tax refund and that he or she must download an attached file and ...

MPs attack HMRCs cosy deals with big business

A committee of MPs has criticised "cosy" deals between HM Revenue & Customs (Hmrc) and big businesses. The MPs singled out Dave Hartnett, permanent secretary for tax, for failing to handle tax negotiations with some big companies properly. The Public ...

HM Revenue & Customs: Income Tax

Find out how much Income Tax you need to pay and the allowances you can claim.

HMRC criticised again for not issuing penalty notices quickly ...

In several Tribunal cases, Hmrc have now been criticised for waiting so long before issuing penalty notices. In one of the most recent cases (Hok Limited) did not file the P35 by the May deadline because the company's one ...

HMRC | Politics | The Guardian

Latest news and comment on Hmrc from guardian.co.uk ... 6 Jan 2012: File your tax return a minute after the midnight deadline and the new system means you will be ...

HMRC to investigate Premier League footballers over secret perks

Premier League footballers and clubs are set to be investigated by Hmrc over claims they enjoy a number of secret perks. A tax probe is due to begin that will look at gifts such as holidays and luxury accommodation and check whether they tally with the ...

No Rangers tax deal from HMRC

RANGERS owner Craig Whyte has told fans the taxman will NOT strike a deal over the clubs reported £40million Hmrc bill. The businessman gave the warning as he met supporters groups at Ibrox stadium. The club is involved in an ongoing battle with Her ...

BBC News - MPs attack HMRCs cosy deals with big business

A committee of MPs has criticised "cosy" deals between HM Revenue & Customs (Hmrc) and big businesses. The MPs singled out Dave Hartnett, permanent secretary for tax ...

Taxman gains new powers to prosecute from the end of this month

HM Revenue & Customs (Hmrc) will gain new powers to prosecute people it suspects are failing to pay whats due from the end of this month. As if the January 31 deadline to file self-assessment tax returns were not daunting enough, McGrigors ...

HMRC - What does HMRC stand for? Acronyms and abbreviations by the ...

Acronym Definition; Hmrc: Her Majestys Revenue and Customs (UK) Hmrc: Health Management Research Center (University of Michigan) Hmrc: Human Mobility Research Centre ...

HM Revenue and Customs - Wikipedia, the free encyclopedia

Her Majestys Revenue and Customs (Hmrc) is a non-ministerial department of the UK Government responsible for the collection of taxes and the payment of some forms of ...

University of Michigan - Health Management Research Center

University of Michigan – Health Management Research Center ... UM-Health Management Research Center (UM-Hmrc) is a world-wide leader in studying how health choices ...

HMRC Phishing Emails | Credit Repair

Hmrc have reported an increase in the number of 'phishing' emails in recent months. These are emails from scammers who disguise themselves as Hmrc, often telling the recipient that they are due a tax refund. Typically ...

What are HMRC random security checks and how long are they presently taking to complete?

Ive been told my SA refund has been selected for a random security check. How long can I realistically expect to wait to receive my refund via BACS?

Im not on the electoral roll, have never bothered really. I recently split with my wife and live with my brother, will this prevent me from getting my refund?

Answer: They will be checking that you are actually who you say you are, usually by looking at the Electoral Roll. Length of time it takes depends on how many other people are in the queue.

Category: United Kingdom

HM Revenue & Customs: PAYE for employers

Helping you deal with PAYE, National Insurance, expenses and benefits

HM Revenue & Customs: Alternative Dispute Resolution trial for ...

Alternative Dispute Resolution trial for Small and Medium Enterprise Customers. HM Revenue & Customs (Hmrc) is extending the Alternative Dispute Resolution (ADR ...

Tax probe over player perks

Investigators from Her Majestys Revenue and Customs (Hmrc) have interviewed finance directors at Britains richest clubs to find out about soccer players benefits, according to The Mail on Sunday. Hmrc refused to confirm the investigation but it was ...

When do I need to register my business with HMRC and when do I need to register as an employer?

Hi,

Am looking to run a catalogue distribution business and about to employ my first employee, I was just wondering

when do i need to register my business with Hmrc and when do i need to register as an employer?

Can I employ someone without registering as an employer and at what point do i have to register?

Answer: How you going to know how much tax and NI to charge? You need to tell Hmrc that you are self-employed sole trader and that you are going to employ someone as soon as possible.

If you are going to incorporate a company then you need to form that company and register it at Companies house. Get an accountant!

Category: United Kingdom

Forum slams HMRC’s harassment and mistreatment of small businesses

The Forum of Private Business is warning firms to pay their tax bills on time or face large fines, amid criticisms that HM Revenue and Customss (Hmrc) paperwork spot checks regime is targeting them at the expense of large companies. The Forum has written ...

HM Revenue & Customs: VAT

Payments and refunds of VAT to or from Hmrc; Changing or cancelling your VAT registration; VAT problems, mistakes, adjustments, inspections; International trade, ...

TaxAssist Accountants - HMRC issues tax return reminder

Hmrc issues tax return reminder. Date: 9th January 2012. Taxpayers across the UK have been reminded of the need to file their self-assessment tax returns before the ...

@paullewismoney @BBCBreakfast Hmrc refund etc has been turning up in the spam folder regularly over about the last 2 years From: daffersdesigns - Source: web

@louisbarabbas how about a Hmrc song? Must be some potential in miscalculated tax credits. From: PendleburyPete - Source: Twitter for iPhone

@plasticrosaries if you submit between April and October, Hmrc will calculate your tax for you. After then, you have to calculate it. From: kateab - Source: TweetDeck

Reading about Rangers shares being suspended. Football clubs are special, but why is Hmrc so lenient with them? From: NigelANicholson - Source: web

In other news Hmrc have decided Im no longer worthy of investigation.. Must of seen my bank balance.. From: FolkBoy - Source: Twitter for iPhone

@seasidesunset I thought cerebral tax returns being done were for 2010/11 whereas I started 11/12? Ill ring Hmrc tomorrow From: plasticrosaries - Source: Twitter for Android

By hiring @VodafoneUK CFO @O2 have gambled that Hmrc tax scandal (@UKuncut) will not follow. Serious risk to company. From: cosmopolymath - Source: Twitter for iPhone

@MunKi77 took baccy and car then returned car with formal warning and threat to permenantly sieze car next time. #Hmrc jobs worth or what! From: MOT_Tester - Source: Twitter for Android

RT @paullewismoney: Any Hmrc phishing scam experiences gladly received overnight! From: sheppeydragon - Source: web

RT @RachelCorsie: Rangers shares suspended.... shame! can slip the ref a tenner but not the Hmrc! From: kirstiphine - Source: web

Hmrc to resolve SMEs tax disputes without tribunal http://t.co/rtLagYmW From: prolawrssfeed - Source: twitterfeed

Freelancers Questions: Is changing accountant a red flag to Hmrc?: Freelancers Question: Is changing my accoun... http://t.co/epP5deGz From: williamwebb01 - Source: twitterfeed

@SeanyH26 hiding behind legal technicalities to avoid payment. Hopefully Hmrc wont find anything untoward. #untrustworthy From: DorsetAllstars - Source: Twitter for iPhone

RT @Paul_A_Mediator: Hmrc trains mediators for small business tax disputes - Telegraph http://t.co/3E1I4Bw9 via @Telegraph From: SheenaGhamy - Source: Tweet Button

@ArcticReviews lets hope so! If Hmrc have anything to do with it, Im sure well make it over the line :0) From: sirbeardypants - Source: Twitter for iPhone